Payroll is one of the most sensitive yet essential functions for any business. It involves not only transferring salaries but also staying compliant with statutory obligations. RazorpayX Payroll offers a structured approach to managing these responsibilities, focusing on automation and ease of use. It integrates various aspects of payroll, such as PF, ESI, TDS, and PT filings, along with employee benefits and insurance, into one system.

The RazorpayX Payroll mobile app provides employers and employees access to core payroll features from anywhere. Key tasks such as viewing payslips, approving payroll runs, and checking compliance status can be done through the app.

To download and install on Android:

The app syncs with the web dashboard, ensuring continuity of tasks across devices.

RazorpayX Payroll is accessible via browser and optimized for various devices. While the mobile app offers flexibility for viewing reports and managing tasks on the go, most operational features are retained on the desktop platform.

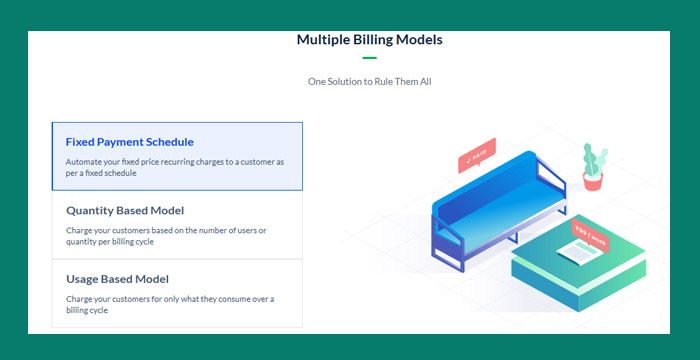

RazorpayX Payroll functions within a broader suite of tools:

These can be managed under a single Razorpay login, depending on subscription and service usage.

The tool is suitable for startups, SMEs, and mid-sized businesses looking to reduce manual dependency. However, integration with RazorpayX Current Accounts may be a prerequisite for certain features. Enterprises with complex salary structures or international compliance needs may require additional configuration or custom solutions.

Based on user feedback from founders and business operators:

Businesses with high transaction volumes or regulatory requirements can opt for enterprise plans. These may include support for higher concurrency, dedicated onboarding, and additional payout features.

RazorpayX Payroll serves as a consolidated payroll and compliance tool for businesses operating in India. It supports both employee-facing and employer-facing processes, automates filings, and integrates benefits in one system. While suitable for most small to mid-sized companies, businesses with unique needs may need to assess compatibility or explore enterprise plans.

Sign-up and login options are clearly defined, and documentation is publicly accessible. The platform is structured to support financial accuracy, data visibility, and compliance in a streamlined manner.

Be the first to post comment!